As immunization plans unfolded and case counts continue to fluctuate, the COVID-19 pandemic has had a dramatic effect on your facilities operations and strategy. . If your organization was deemed an essential service, your facilities were modified to provide safe conditions and your support functions were likely transitioned to remote or hybrid working arrangements. Needless to say, if you have reduced occupancy, it’s time to review your real estate portfolio and explore ways to generate savings, whether this means streamlining your operations and maintenance strategy, tailoring energy use to reflect the reduced occupancy or identifying cost centres that have an ability to re-evaluated.

Midway through 2021, Building Owners and Managers Association (BOMA) International released findings from its real estate impact study. Participants were optimistic about returning to the office. Seventy-eight per cent believed the in-person office was still vital, and only 26 per cent of tenants in the study believed their workforce would telework full-time/most of the time. Is this the case for you? Do you have a plan for when your staff returns?

Here are three steps you can take to optimize your current real estate portfolio and create opportunities to generate key cost savings for your business.

Review your real estate footprint

Now is the time to review the assets in your portfolio and determine whether these properties are vital to your goals. You should also allow for adequate time to reassess business needs and whether surplus space may be suitable for divestment, additional swing space is required or the space is best subleased. As well, the current office or cubicle space may be underutilized. Depending on whether the properties are owned or leased, you should explore whether to renovate, sublease, terminate and/or sell the space.

A recent story on FMLink argued that, according to facility and property management industry benchmarks, the average occupancy cost per full-time equivalent (FTE) varies from $8,000 to $12,000 in North America. The same piece said it’s possible to bring that figure down to between $7,000 to $8,000 per FTE. The right plan will generate immediate savings as well as long-term savings as you adopt alternative workplace strategies and a streamlined real estate portfolio.

Time to update operations and processes

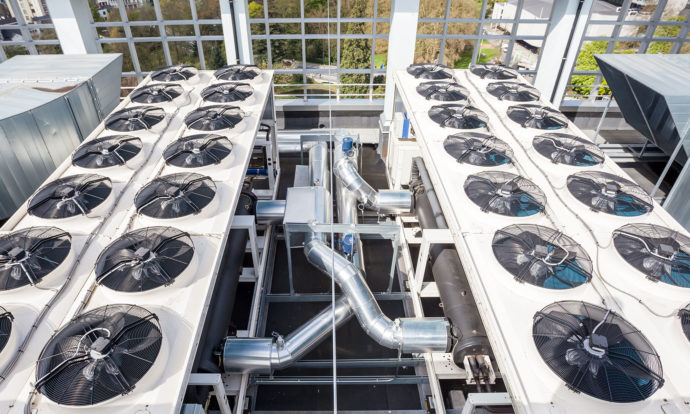

With a soft commercial real estate market, it may be time to optimize your asset plan and capture savings through depreciation and other financial incentives. At the same time, you can review your building technologies and processes and establish which technologies can be updated and which processes can be automated. Capitalize on new software applications available for HVAC, fire suppression, equipment diagnostics, security, lighting, work order dispatch and management. With precise monitoring and management, you can drive energy and operational savings that will improve the bottom line. Bring your facility services companies to the table and engage them to streamline operations and deliver savings.

Partner and maximize gain-sharing opportunities

The pandemic likely revealed waste and inefficiency in your real estate and facilities portfolio. You may need to refocus your efforts away from facility management towards other key business priorities. If so, it may make sense to outsource the function, but make sure you enlist a trusted facility services company who will provide value to your bottom line. It’s also a good opportunity to evaluate whether you can consolidate your vendors to streamline your business and operational processes and reduce the vendor management and supervision required.

Explore gain-sharing agreements with your service provider that are focused on providing an outcome-based delivery model. This will meet the basic underlying terms and conditions of contractual agreements and allow you to invest in improvements to your business. Investing in energy conservation measures that improve the energy efficiency of your real estate portfolio will pay off now as well as in the long-run. For example, strategic gain-sharing agreements that reward reduced facility/portfolio energy use will help you establish long-term partnerships for success and generate savings, making it a win-win.

Seize the moment to boost your financial performance. Transform your operations and resist the temptation to fall back into old patterns.

Black & McDonald is an integrated, multi-trade facility services provider, with insight into directing a diverse portfolio of public and private facilities. Our clients partner with us to ensure that facilities are safe and efficient for all users, and that service excellence and best value are delivered throughout our agreements. Our experts help identify opportunities to improve facilities and to develop tailored solutions for your operations.